Will the New Orleans Market Crash?

Miss the event "Will the New Orleans Housing Market Crash?" Here are some highlights from the event.

Q- The last two years have been crazy in the real estate market. We’re starting to see a bit of a slowdown. A year ago, houses were selling for over asking, in days. It seems like houses are starting to sit for a little while. What do you think is causing that shift?

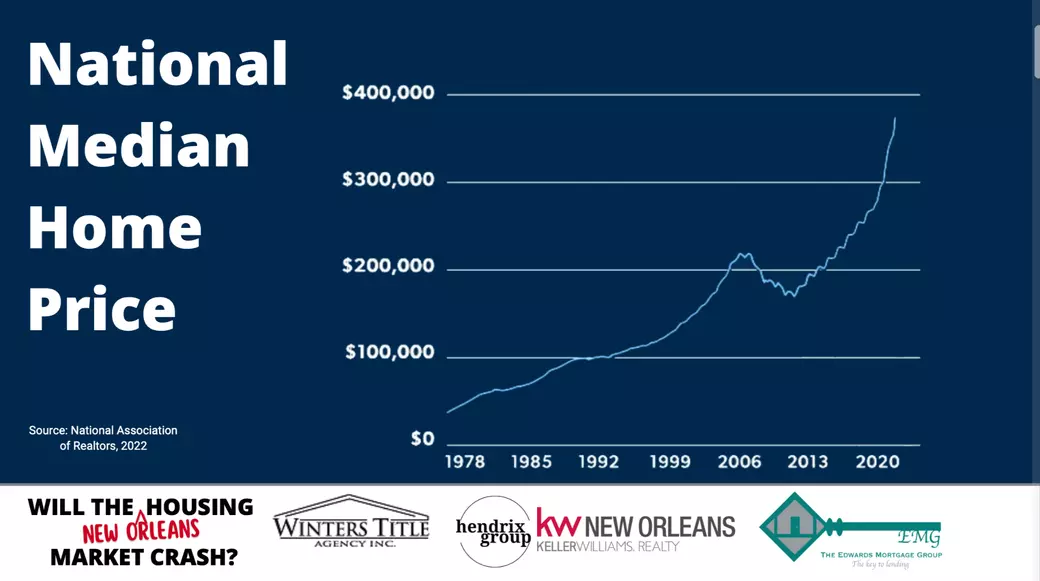

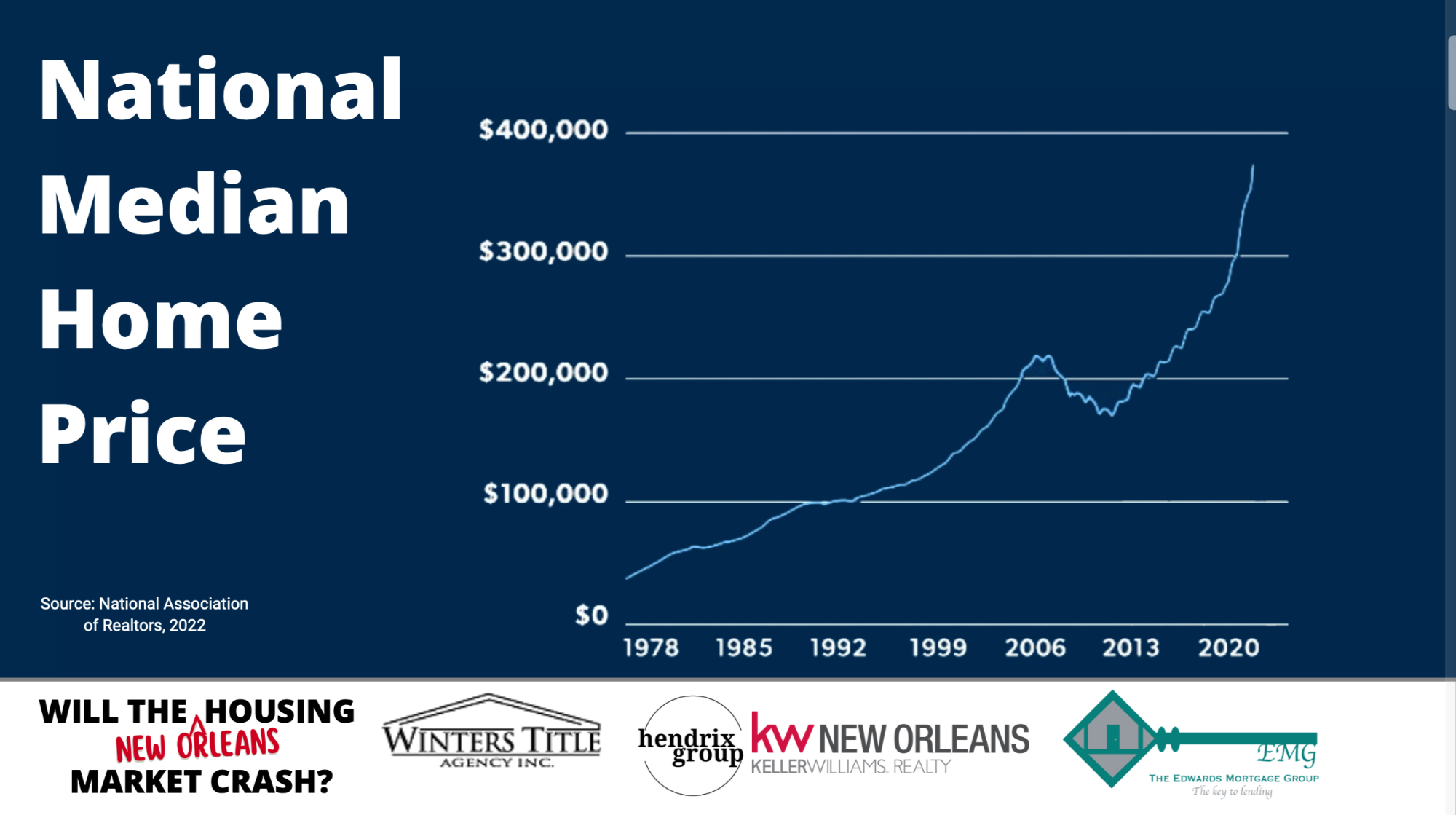

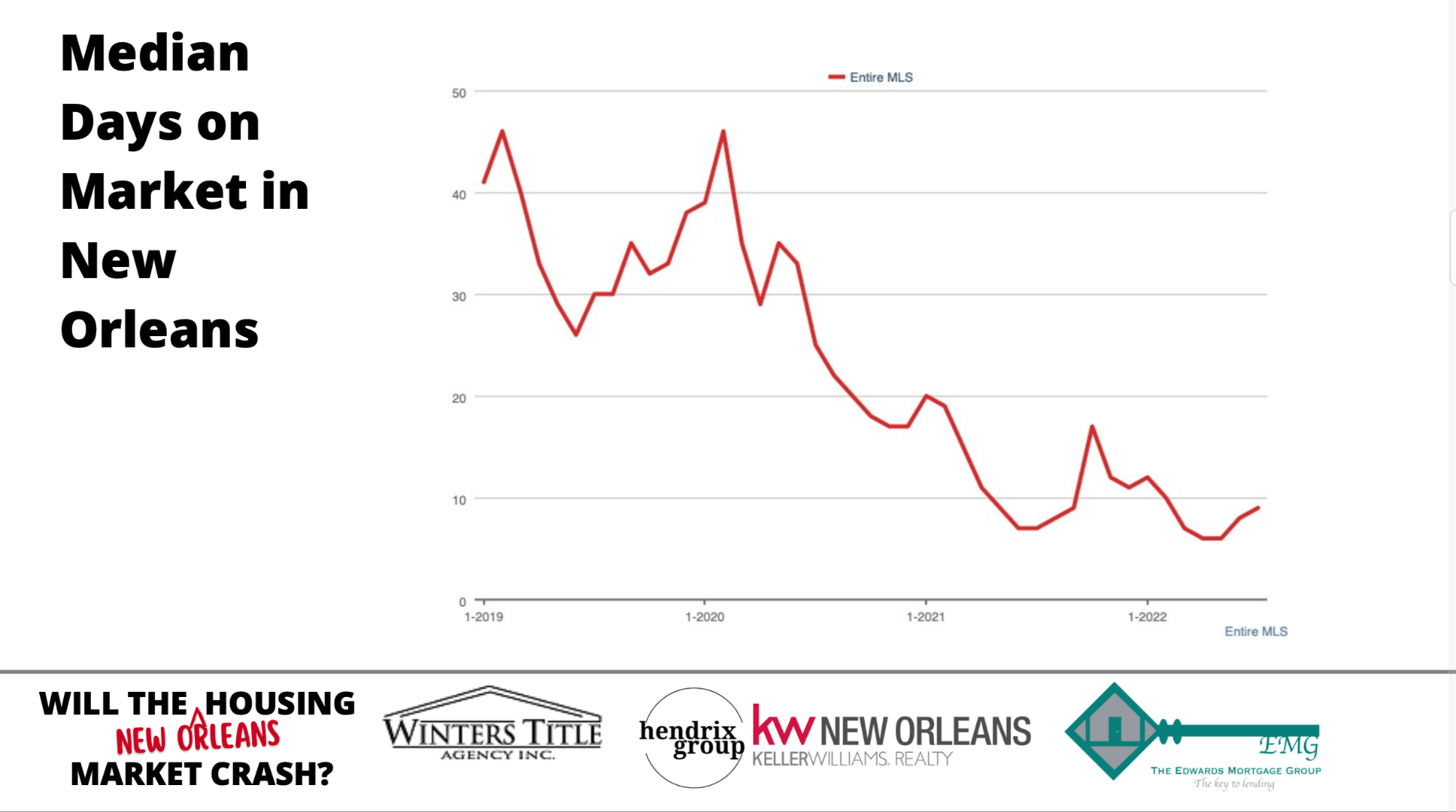

John - In New Orleans, We've been in a robust seller's market for the last few years. It was white hot. The national median house price has skyrocketed over the last seven years. Home prices in the New Orleans metro area have increased nearly 28% in three years. This is a crazy increase. We saw extremely low inventory with still high demand. This is what drove the white-hot seller's market.

At the start of the summer, we started to see a shift in the market. Instead of seven days on the market for sold homes, we started seeing an average of nine days. We started to see slightly more inventory and a slight price decrease.

This is still a very good seller's market. The shift is giving buyers more time to make a decision on which home fits their needs. Buyers can see a home and go to dinner before deciding to put in an offer.

Q - We're seeing a ton of national headlines that we may or may not be going into recession. In the last recession of 2008, the housing market was hit hard. Do you think history is going to be repeating itself? What are you seeing in the market?

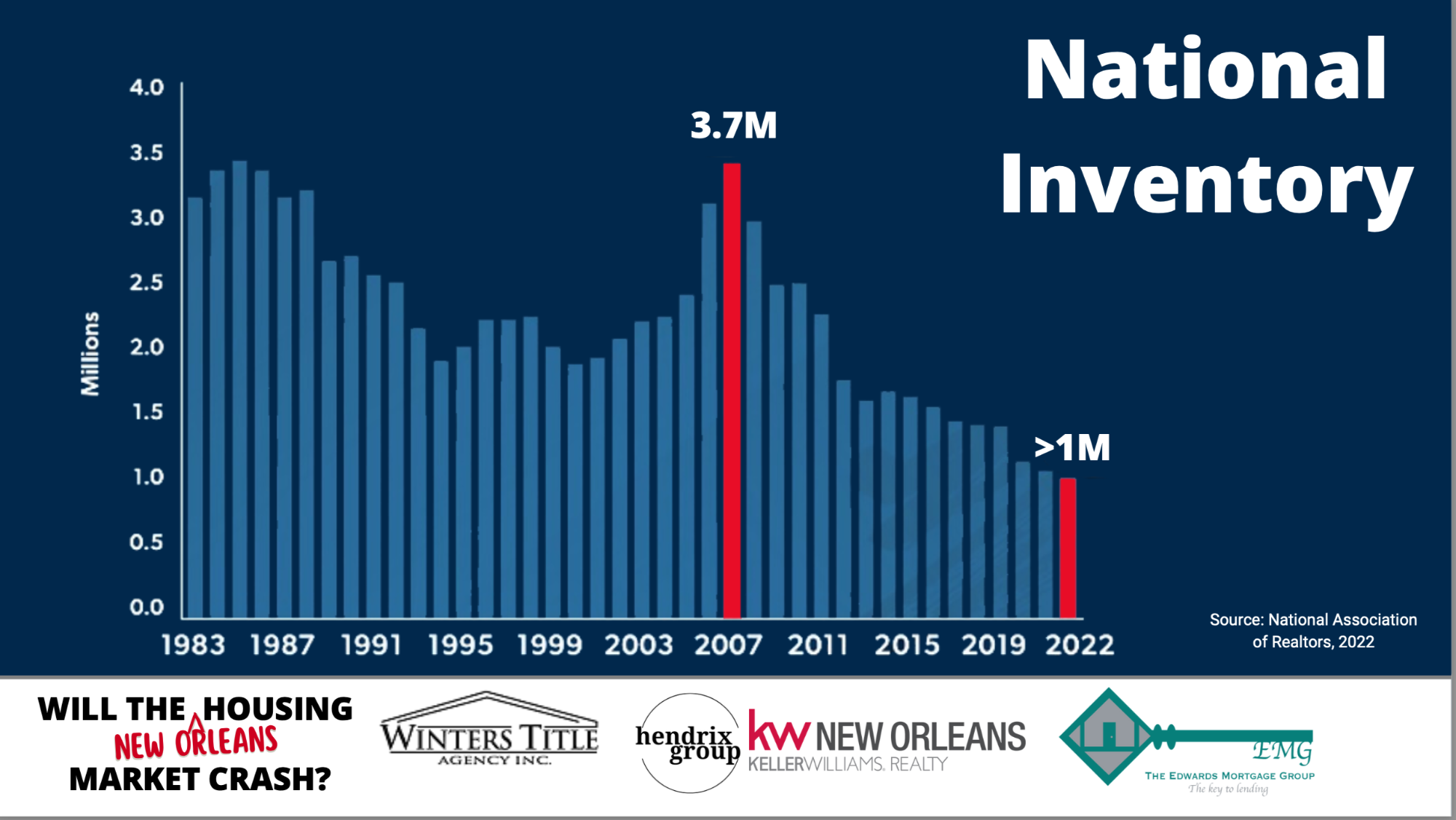

John- No. A lot has changed in the mortgage world in the last 15 years. In 2008, we saw a very high supply of homes for sale. Today, the number of homes for sale is very low historically. Plus there are about 5,000,000 more people of prime homebuying age. We're seeing low supply and high demand still in the market.

Q- We're seeing a lot of increases in home insurance. What are some things you advise your clients to do early in the process around insurance? Either buyers or sellers?

John - I'm seeing some investors trying to navigate this process increase. Some are selling. Some are carrying less insurance. Some are raising rents to cover some of the cost. Sellers can transfer flood insurance policies. A transfer policy is capped on the amount of increase year-over-year, unlike a new policy. This can be a way to save your potential buyer hundreds of dollars a year.

Q- If rent is going up across the market now rent in the area is comparable to a mortgage payment. Do you think this is a good time to make that jump into home ownership?

John, Yes. Rents are rising so quickly in this metro. One of the benefits of owning a home is that your housing costs are fixed. You don't need to worry about your housing costs varying dramatically.

For more information about local New Orleans market trends, please contact John Hendrix at john@hendrixgroupnola.com

Categories

Recent Posts

GET MORE INFORMATION